What's the score?

Your credit score can mean the difference between being denied or approved for credit. A good credit score can help you get a lower interest rate on a mortgage or automobile loan, qualify for an apartment rental, or even get a job. A low score can cost you more for insurance or your cell phone plan.

Your credit score is a three-digit number which is formulated by using information from your credit history. It's designed to measure your credit risk and help banks and other institutions make lending decisions.

There are many credit-scoring providers, but the predominant one in the U.S. is the FICO credit score. According to myFICO.com, the consumer website for Fair Isaac Corporation, the FICO score developer, "90% of the largest banks use your FICO® credit score for credit decisions."

FICO scores range from 300 to 850 and the higher the number, the lower your credit risk. What is considered a good score? Well, that can depend on the lender and also fluctuate with the current economic conditions. Generally, 725-760 is considered good credit, while above 760 is considered excellent.

How is a credit score determined?

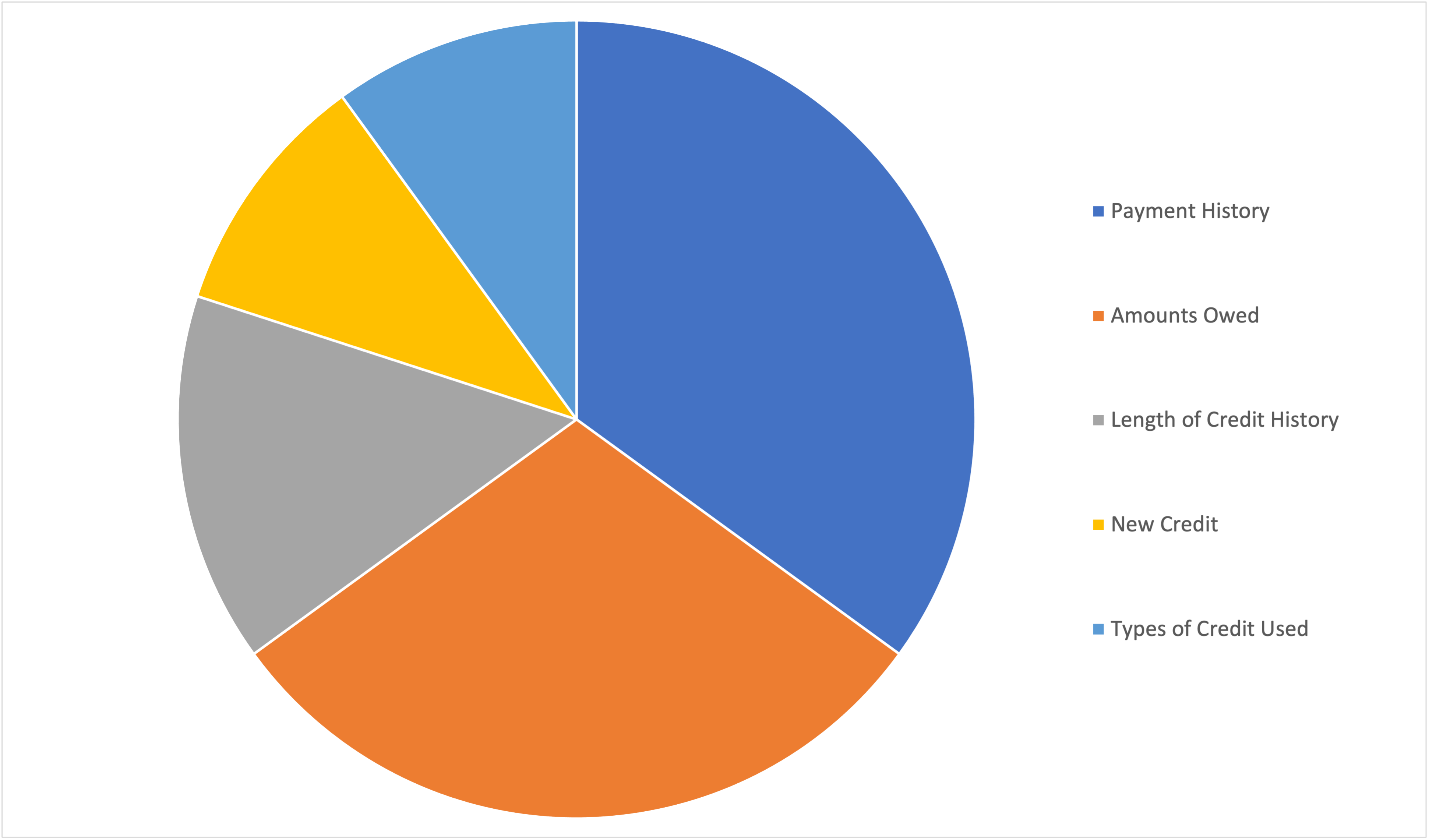

Information from your credit report goes into five categories that make up your FICO score. Each category carries a certain weight that goes into the decision making process.

Categories of your credit score (and weight carried):

Payment history: (35 percent) — Your account payment information, including any delinquencies and public records. Late payments on bills, such as a mortgage, credit card or automobile loan, can cause a FICO score to drop. Bills paid on time will improve a FICO score.

Amounts owed: (30 percent) — How much you owe on your accounts. The ratio of amount owed relative to amount available on revolving accounts is heavily weighted. Therefore, low balances and higher credit limits will improve your credit score. On the other hand, closing existing revolving accounts may lower your ratio of amount owed to credit available and negatively impact your score.

Length of credit history: (15 percent) — How long ago you opened accounts and time since account activity. A long credit history can have a positive impact.

Types of credit used: (10 percent) — The mix of accounts you have, such as revolving and installment. Consumers can benefit by having a history of managing different types of credit.

New credit: (10 percent) — Your pursuit of new credit, including credit inquiries and number of recently opened accounts. Having one or more new credit accounts can sometimes hurt scores. Credit inquiries initiated as a self-check, while shopping for a mortgage or auto loan, by an employer for the hiring process, or by companies planning pre-screened offers generally do not impact your credit score.

It is important to note that personal or demographic information such as age, race, geographic area, marital status, income and employment does not affect the score.

Can I get my credit score?

The Fair Credit Reporting Act gave consumers access to free annual credit reports from the three major credit reporting agencies, but does not mandate free credit scores. Some sources, such as Bankrate.com, offer free calculators to help you estimate your credit score range. However, to get your exact number, you have to purchase it from the score provider. If you don't take your credit seriously, a bad score can cost you hundreds or thousands of dollars over your lifetime. So for consumers who want to get smart about their credit, this could be a worthwhile investment.